Introduction

In accounting, precision is crucial, and Double Entry Accounting is fundamental to ensuring financial accuracy. This method records each transaction in two separate accounts: a debit and a credit. By affecting both sides of the accounting equation (assets = liabilities + equity), Double Entry Accounting maintains the equilibrium of financial records. This system is essential for preserving the integrity of financial data, enabling businesses to track their financial health comprehensively while adhering to stringent accounting standards.

Double Entry Accounting provides a complete and balanced view of a company’s financial activities. It ensures that every transaction is accurately recorded in a journal account, with both a debit and a credit entry. This meticulous approach upholds the fundamental accounting equation and simplifies financial reporting, allowing businesses to make informed and strategic decisions for sustained success.

Add-On Purchase Steps

After enabling the Double Entry Add-On by the super admin, follow these steps to purchase and access the add-on:

- Purchase the Add-On

- Visit the “Subscription Plan” page.

- Select the appropriate “Usage Plan.”

- Locate the Double Entry Add-On and complete the purchase.

How to Use the Double Entry Add-On

After purchasing the Double Entry add-on, follow these instructions to use it:

- Access the Double Entry Add-On

- Find the add-on in the menu.

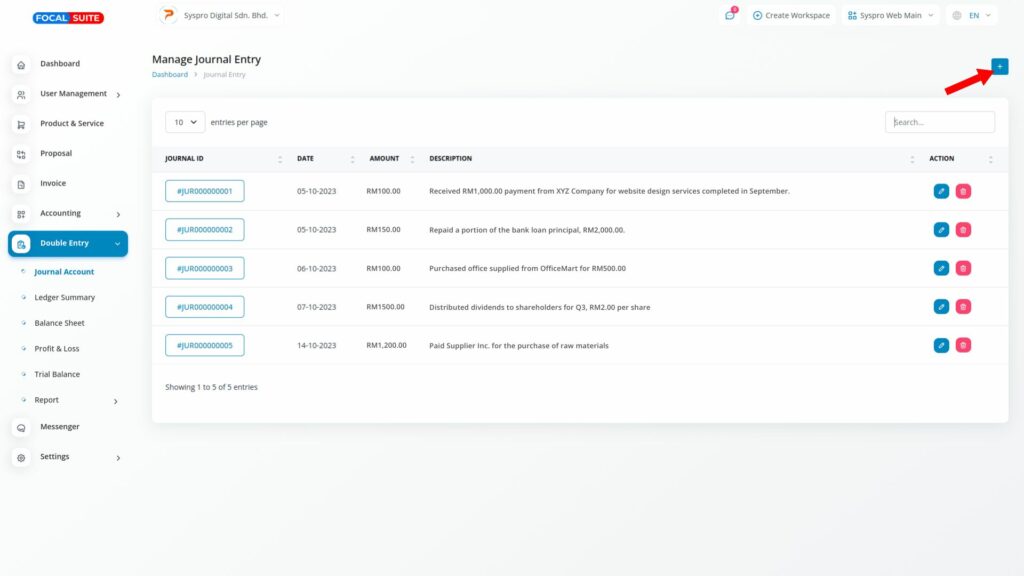

- Journal Account Page

- Create Journals: Add all required details to create journal entries.

- Edit Entries: Make changes to journal entries as needed.

- Create Journals: Add all required details to create journal entries.

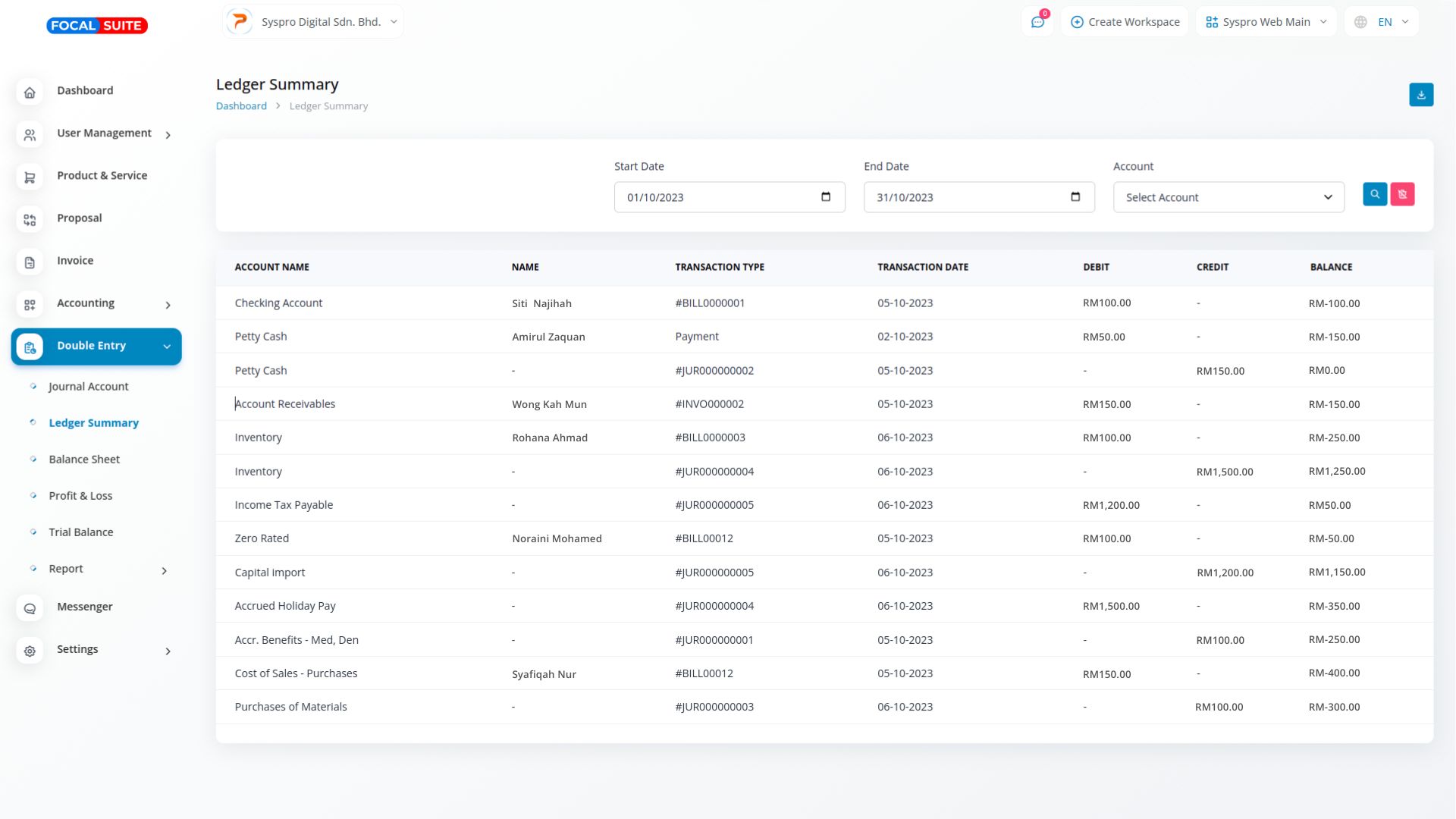

- Ledger Summary Page

- View History: See the history of all ledgers.

- Download: Download ledger summaries if needed.

- View History: See the history of all ledgers.

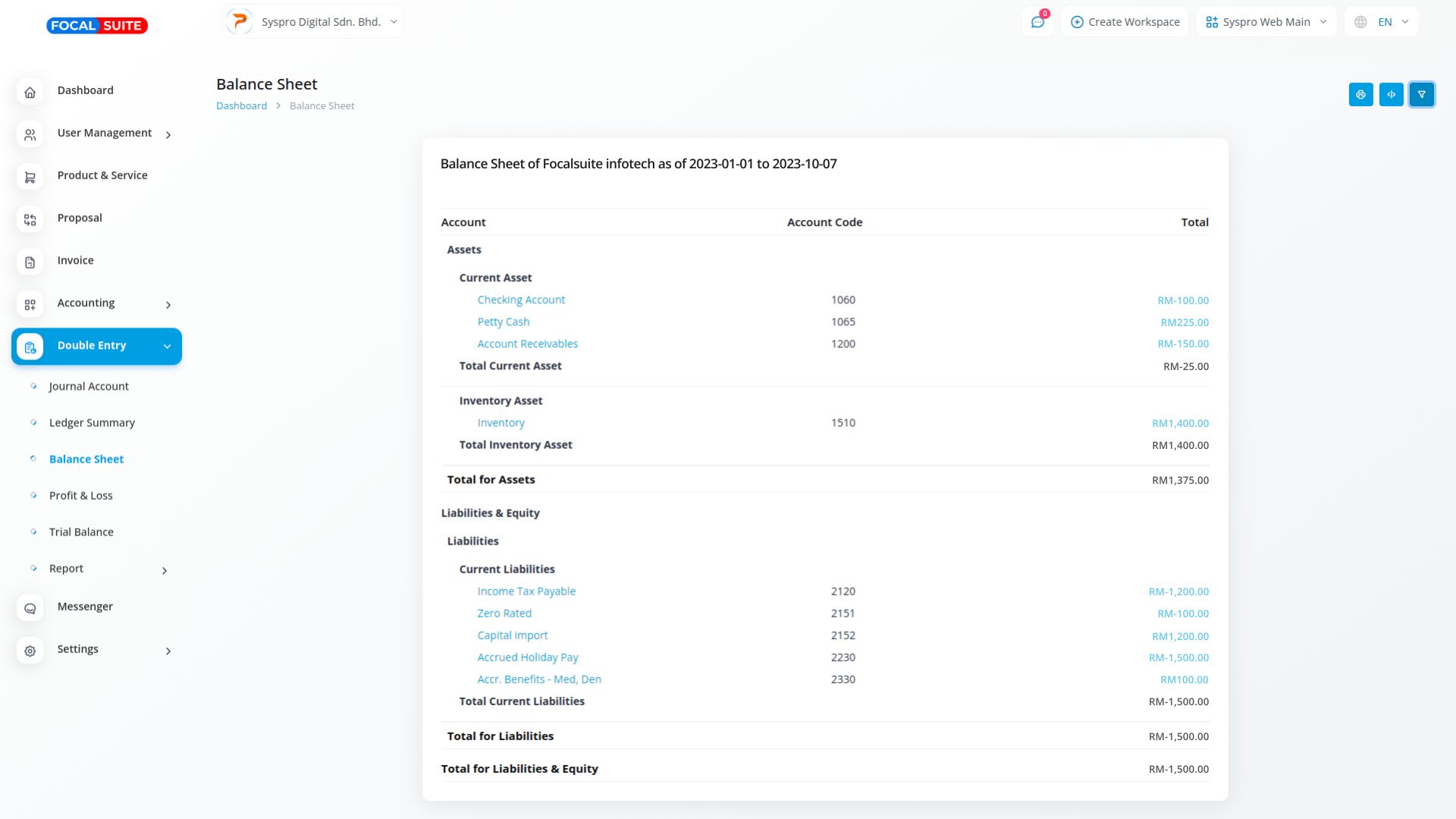

- Balance Sheet Page

- View Balance Sheet: Access the balance sheet of your account.

- Print: Print the balance sheet as required.

- View Balance Sheet: Access the balance sheet of your account.

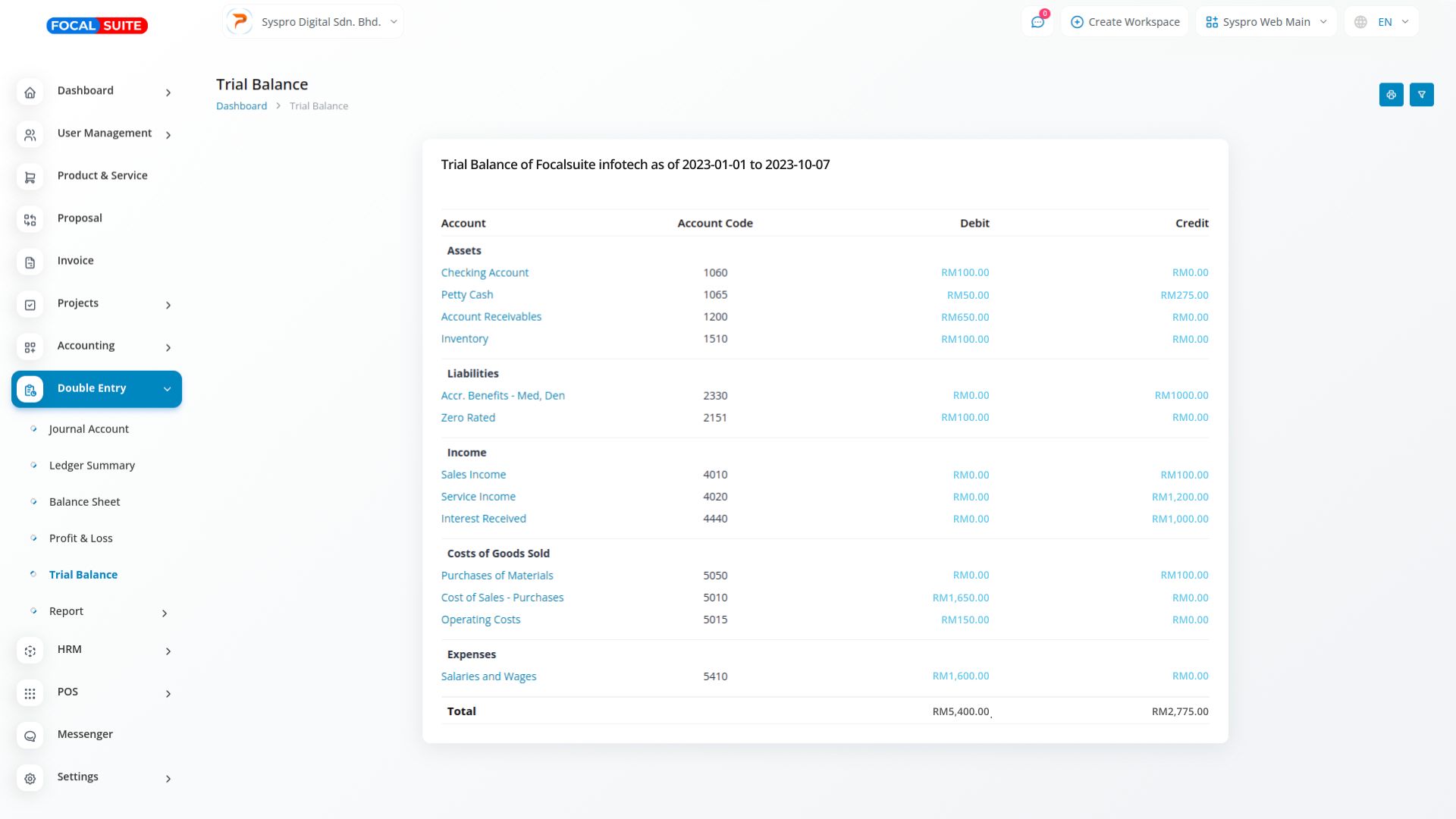

- Trial Balance Page

- View Trial Balance: Check the trial balance of your accounts.

- Print: Print the trial balance if needed.

- View Trial Balance: Check the trial balance of your accounts.

- Sales Report Page

- View Reports: Access and review sales reports.

- Print: Print sales reports as necessary.

By following these steps, you can effectively manage your financial records using the Double Entry add-on.